Under pressure from the IMF, Egypt's government reduces its share in Eastern Co. Read More

Altria has declared war on the illicit disposable devices that are impacting its bottom line.Read More

Despite regional setbacks, global cannabis sales are still getting higher.Read More

Tobacco harm reduction for people with mental health needsRead More

Hertz Flavors celebrates its first year of operating in Indonesia. Read More

A German startup deploys foam to deliver nicotine.Read More

With its origin-focused approach, CTS has become a successful niche player in the French RYO category.Read More

With its first overseas production facility, Smoore has boosted the resilience of its operations. Read More

Britain’s plan to create a smoke-free generation could be momentous if implemented properly—and herein lies the problem. Read More

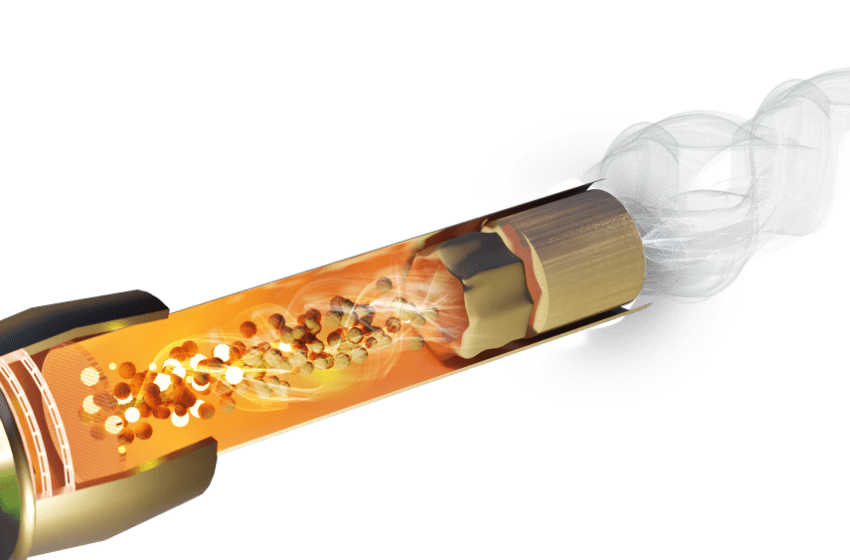

There are multiple ways to heat tobacco without burning it.Read More

Recent Posts

- Healthcare Providers Urged to Discuss Vapes

- Vape Shop Owners Challenge Kentucky Registry Bill

- Smokers Ordered to Keep Distance

- Former BAT Subsidiary Engages in Ruble-Yuan Swaps

- German Court Rules in ‘Cuba’ and ‘Habana’ Cigar Suit

- Shay Mustafa Named One of Most Influential Executives

- CTP Launches Webpage on Relative Risks

- PCA Reflects on Successful Trade Show

- Britain’s Generation Ban Passes First Vote

- PMI Eyes Philippines Leaf for Smoke-Free

- KT&G Volunteers Assist With Transplanting

- FDA Denies Market Access to Yibo Products

- ITCAN Launches Zonnic Awareness Campaign

- Criticism Mounts as U.K. Debates Generation Ban

- Mariana Islands Fails to Adopt Tobacco Report